Table of contents

Financial well-being is a critical component of holistic well-being. And although money is not everything and life consists of countless factors that you can’t buy, bills won’t pay themselves.

Why is it acceptable to discuss job satisfaction, work environment and our relationships with colleagues, but controversial to talk openly about money? It’s a taboo topic. However, the increasing importance of financial transparency in today’s labor market may soon change this situation.

Let’s take a look at some data on money-related issues:

- The share of U.S. job postings on Indeed advertising employer-provided salary information more than doubled between February 2020 and February 2024, rising from 18.4% to 43.7%.

- According to a Thriving Wallet study, over 40% of individuals wish that they could have a ‘fresh’ financial start.

- A 2021 Pew Research Center report shows that worries about financial security are related to higher levels of psychological distress.

- According to a survey from Fidelity Investments, 85% of Americans who counter-offered during salary negotiations were successful.

At Resume Now, we surveyed more than 1,100 employees to examine:

- How people feel about their financial situation these days.

- Sources of money-related stress.

- Salary negotiation, pay raises and promotions.

- The influence inflation and recession have on our professional life.

- Pay range in job offers.

- Financial dilemmas employees share.

- Financial transparency in the workplace and beyond.

Key findings:

- 87% of participants had to take on at least one side job for financial reasons in the last six months.

- Only 37% could afford an unexpected expense of $400. Also, almost 6 in 10 (58%) couldn’t afford to buy a new pair of shoes today.

- 84% believe that job postings should always include a salary range. Additionally, 45% declare unwillingness to apply to job listings without information about a pay range.

- 98% say they feel more confident about asking for a raise this year compared to the same time last year.

- 65% have quit a job because they were denied a raise.

- 58% claim they have financial stressors.

- Credit card debt (34%), building one’s emergency savings account (21%) and saving for retirement (30%) are the top financial stressors reported.

Keep reading to find out what our study uncovered.

Feeling Financially (In)Secure

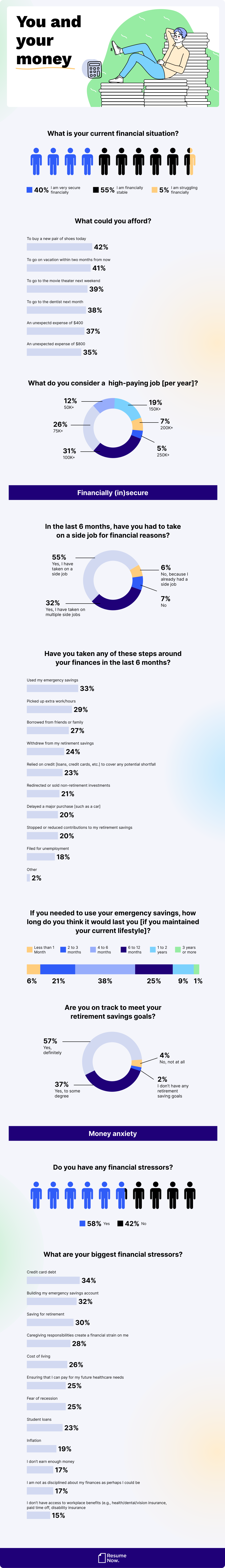

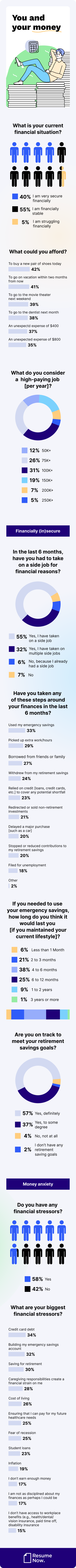

To start with, respondents were asked to assess their current financial situation.

- 40% claimed they were very financially secure and 55% viewed themselves as financially stable. Only 5% said they were struggling financially.

- Self-employed (53%) and Republicans (53%) considered their financial situation as very secure, which makes them the two demographics declaring the greatest financial satisfaction. Conversely, participants with an annual income of less than $25,000 were least satisfied with their finances – 13% of them claimed they were struggling financially.

Let’s dig deeper.

We also asked a series of detailed questions, investigating what surveyed participants could afford. Here’s the full breakdown of the answers:

What could you afford?

- To buy a new pair of shoes today – 42%

- To go on vacation within two months from now – 41%

[software/IT — 50% vs. healthcare — 30%] - To go to the movie theater next weekend – 39%

- To go to the dentist next month – 38%

- An unexpected expense of $400 – 37%

[men — 43% vs. women — 31%] - An unexpected expense of $800 – 35%

Which leaves us with a huge discrepancy.

95% of respondents defined their financial situation as at least stable, but as many as 58% couldn’t afford to buy a new pair of shoes today. And only 37% could afford an unexpected expense of $400.

Survey takers also revealed what they considered to be a high-paying job (per year).

- $50K+ – 12%

- $75K+ – 26%

- $100K+ – 31%

- $150K+ – 19%

- $200K+ – 7%

- $250K+ – 5%

Not surprisingly, respondents with the lowest annual income ($25,000 or less) presented different views than those with the highest earrings ($75,0000 or more). $50,000+ was considered a high salary by 39% of participants with the lowest annual income and by 0.3% of employees with the highest earnings.

Let’s find out how respondents deal with financial challenges.

- 87% had to take on at least one side job in the last six months for financial reasons. 32% of those had taken on multiple side jobs. The percentage increased to 50% in the case of participants without a college degree.

- Overall, only 7% of all survey takers did not have to take such a step as starting a side job.

Finding sources of extra income is not the only option to improve one’s financial situation. We asked, “Have you taken any of these steps regarding your finances in the last six months?”. Participants could choose all the options that applied. Here’s what they answered:

- Used my emergency savings – 33%

- Picked up extra work/hours – 29%

- Borrowed from friends or family – 27%

- Withdrew from my retirement savings – 24%

- Relied on credit [loans, credit cards] to cover any potential shortfalls – 23%

- Redirected or sold non-retirement investments – 21%

- Delayed a major purchase [such as a car] – 20%

- Stopped or reduced contributions to my retirement savings – 20%

- Filed for unemployment – 18%

- Other – 2%

We also wanted to know what would happen if respondents started using their emergency savings without changing their lifestyle.

If you needed to use your emergency savings, how long do you think it would last you [if you maintained your current lifestyle]?

- Less than one month – 6%

- Two to three months – 21%

- Four to six months – 38%

- Six to 12 months – 25%

- One to two years – 9%

- Three years or more – 1%

The last question from this survey section regarded retirement savings.

- 94% of participants claimed they were on track to meet their retirement savings goals, and 4% that they were not. 2% declared they didn’t have any retirement savings goals.

Let’s move on to the topic of money anxiety now.

Money Anxiety

58% of respondents admitted they had financial stressors. The highest levels of money-related stress were reported by participants without a college degree (75%), master’s degree holders (75%) and small (up to 10 people) company employees (72%). Conversely, the self-employed (39%) and healthcare industry workers (39%) showed the lowest financial stress.

Let’s dig deeper.

Credit card debt (34%), building one’s emergency savings account (21%) and saving for retirement (30%) were the top financial stressors reported. But the list doesn’t end there. Here’s the full breakdown of the answers.

What are your biggest financial stressors?

- Credit card debt – 34% [men — 42% vs. women — 23%]

- Building my emergency savings account – 32% [men — 37% vs. women — 29%]

- Saving for retirement – 30%

- Caregiving responsibilities create a financial strain on me – 28%

- Cost of living – 26%

- Ensuring that I can pay for my future healthcare needs – 25%

- Fear of recession – 25%

- Student loans – 23% [men — 30% vs. women — 17%]

- Inflation – 19% [men — 25% vs. women — 14%]

- I don’t earn enough money – 17%

- I am not as disciplined about my finances as perhaps I could be – 17%

- I don’t have access to workplace benefits [e.g., health/dental/vision insurance, paid time off, disability insurance] – 15%

As you see, men reported financial stress in general at a higher rate than women. Apart from that, there were no disparities within other demographic groups to report.

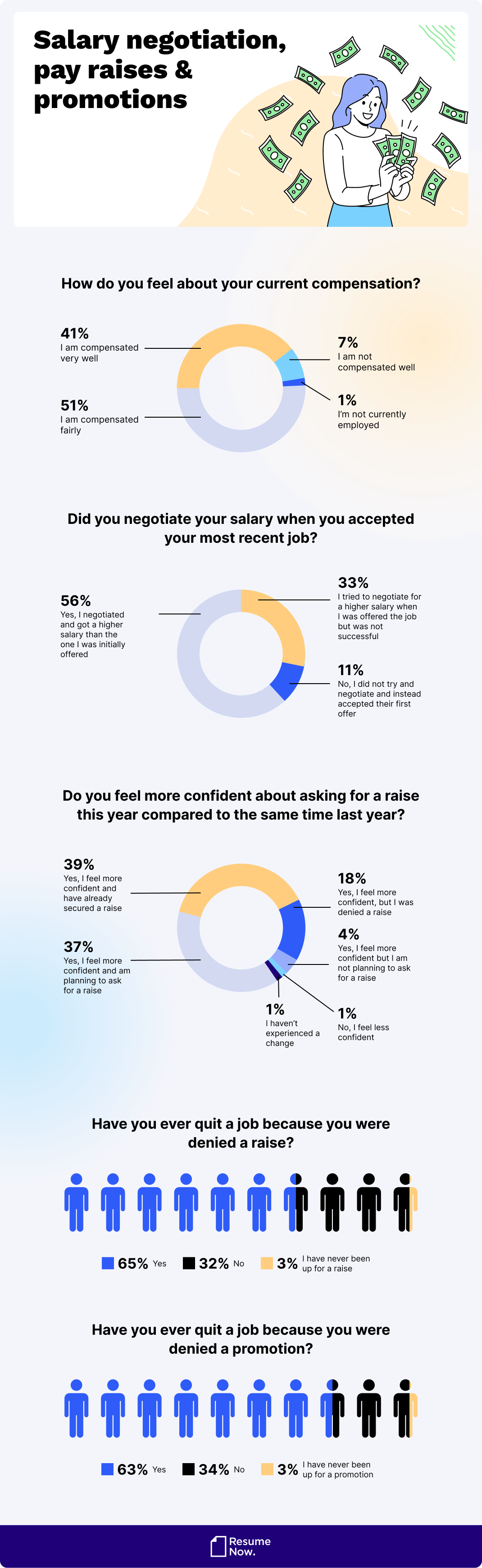

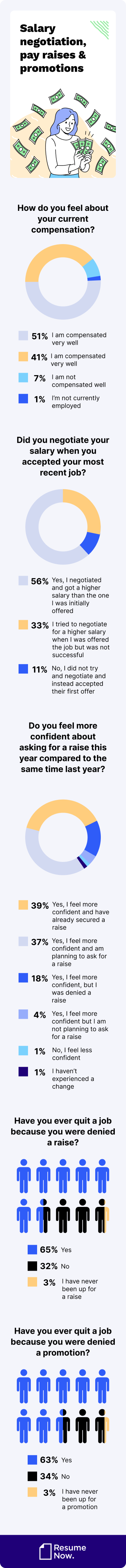

Salary Negotiation, Pay Raises & Promotions

How do our survey takers feel about their current compensation? Let’s find out.

41% believed they were compensated very well. The share of respondents satisfied with their salary was noticeably higher for self-employed (76%). 51% viewed their current compensation as fair, and 7% as too low. The remaining 1% were unemployed participants.

Wanting to see how common (and if successful) salary negotiations are, we asked respondents a question, “Did you negotiate your salary when you accepted your most recent job?”. They answered as follows:

- Yes, I negotiated and got a higher salary than the one I was initially offered – 56%

- I tried to negotiate for a higher salary when I was offered the job but was not successful – 33%

- No, I did not try and negotiate and instead accepted their first offer – 11%

Some other noteworthy research findings to mention:

- 65% of respondents claimed they had quit a job because they were denied a raise. Taking such an action was reported even more frequently by participants without a college degree (79%), master’s degree holders (79%) and manufacturing industry workers (75%).

- 63% said they had quit a job because they were denied promotion. Interestingly, it happened to 80% of no-college degree holders.

- 98% admitted they felt more confident about asking for a raise this year compared to the same time last year. 39% of those had already secured a raise and 37% were planning to ask for it.

Time to move on to today’s financial challenges people face.

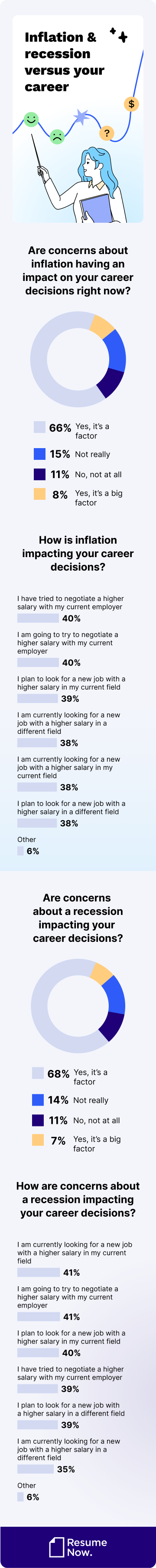

Inflation & Recession Versus Your Career

Inflation and recession often go hand in hand. And they take no prisoners.

“Inflation and recessions are very different economic phenomena, but they are intrinsically linked.

High inflation rates can indicate an impending recession, as businesses react to higher costs by reducing production and increasing prices. And if the Federal Reserve takes action in the form of more rate hikes to curb rising inflation, there’s a risk that the move could help trigger a recession.”

—Kat Tretina, Forbes Advisor

Let’s find out if respondents feel concerned about inflation and recession.

- 74% claimed that inflation was having an impact on their career decisions. The percentage was even higher in the case of the answers given by healthcare industry workers, with 88% stating it as a factor.

- 75% considered a recession an important factor contributing to their career decisions. Once more, the perceived influence of a recession on professional life choices was noticeably greater for respondents working in the healthcare industry, with 85% acknowledging its significance.

Delving deeper, we asked participants how inflation and recession were impacting their career decisions.

How is inflation impacting your career decisions?

- I have tried to negotiate a higher salary with my current employer – 40%

- I am going to try to negotiate a higher salary with my current employer – 40%

- I plan to look for a new job with a higher salary in my current field – 39%

- I am currently looking for a new job with a higher salary in a different field – 38%

- I am currently looking for a new job with a higher salary in my current field – 38%

- I plan to look for a new job with a higher salary in a different field – 38%

- Other – 6%

How are concerns about a recession impacting your career decisions?

- I am currently looking for a new job with a higher salary in my current field – 41%

- I am going to try to negotiate a higher salary with my current employer – 41%

- I plan to look for a new job with a higher salary in my current field – 40%

- I have tried to negotiate a higher salary with my current employer – 39%

- I plan to look for a new job with a higher salary in a different field – 39%

- I am currently looking for a new job with a higher salary in a different field – 35%

- Other – 6%

Let’s switch to the topic of salary information in job postings now.

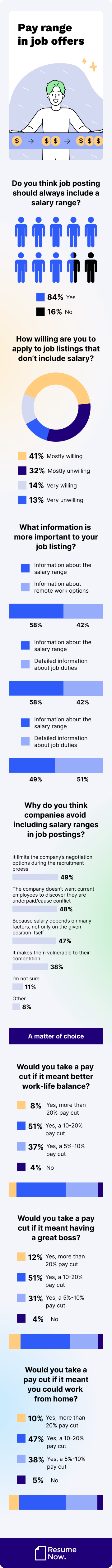

Pay Range in Job Offers

Let’s find out what participants think about a lack of pay range in job offers.

- 84% believed that job postings should always include a salary range.

- 45% claimed they were unwilling to apply to job listings without a salary range.

Digging deeper, we asked what information is more important to respondents in job postings. They were given two options and could choose only one.

What information is more important to you in job postings?

- Information about the salary range — 58% vs. information about remote work options — 42%

- Information about the salary range — 58% vs. detailed information about job duties — 42%

- Information about the salary range — 49% vs. information about the company’s culture and mission — 51%

As the data demonstrates, our respondents reported that salary range was a top concern for a job posting, even outweighing critical information like job duties or remote options. Respondents also revealed their views on why companies avoided including information about salary ranges in job postings. They chose all the options they agreed with. The results were as follows:

- It limits the company’s negotiation options during the recruitment process – 49%

- The company doesn’t want current employees to discover they are underpaid/cause conflict – 48%

- Because salary depends on many factors, not only on the given position itself – 47%

- It makes them vulnerable to their competition – 38%

- I’m not sure – 11%

- Other – 8%

Professional life is an endless process of making choices.

Have you ever wondered what price you would be willing to pay for a better work-life balance, a better relationship with your boss or the chance to work form home? Our research participants had such a chance.

Let the numbers speak for themselves.

Would you take a pay cut if it meant a better work-life balance?

- Yes, more than 20% pay cut – 8%

- Yes, a 10%–20% pay cut – 51%

- Yes, a 5%–10% pay cut – 37%

- No – 4%

Would you take a pay cut if it meant having a great boss?

- Yes, more than 20% pay cut – 12%

- Yes, a 10%–20% pay cut – 51%

- Yes, a 5%–10% pay cut – 33%

- No – 4%

Would you take a pay cut if it meant you could work from home?

- Yes, more than 20% pay cut – 10%

- Yes, a 10%–20% pay cut – 47%

- Yes, a 5%–10% pay cut – 38%

- No – 5%

It should come as no surprise that some things are simply priceless. Even with financial concerns at the forefront of our respondents’ minds, many were willing to make sacrifices that would better their quality of life in other areas.

Let’s move on to financial transparency now.

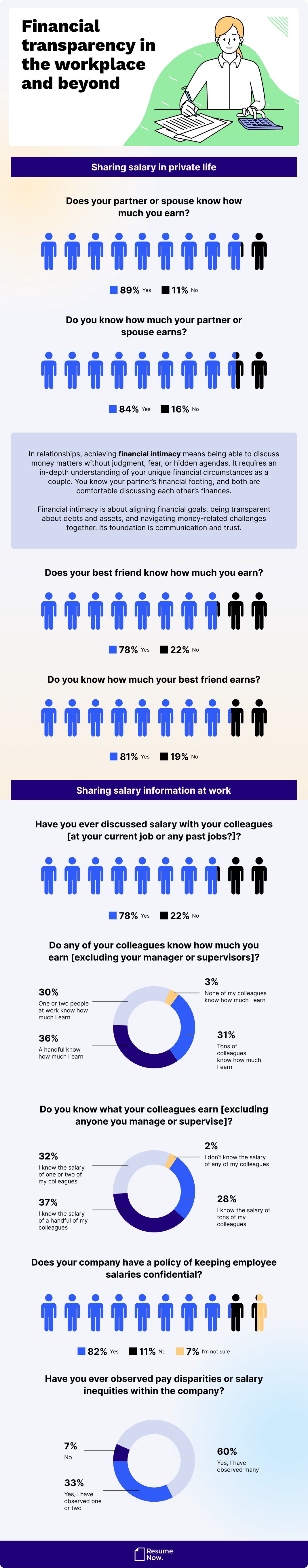

Financial Transparency in the Workplace and Beyond

With a growing number of companies required by law to disclose what they pay, financial transparency is gaining importance. And though talking about finances still evokes emotions, more and more people support the view that the money taboo should be broken.

And here’s how it works.

- A full 89% of the respondents claimed to be open about their earnings with their partners. And, the other way round, 84% knew how much their partners made.

Just a quick comment. In relationships, achieving financial intimacy means being able to discuss money matters without judgment, fear or hidden agendas. It requires an in-depth understanding of your unique financial circumstances as a couple. You know your partner’s financial footing and both are comfortable discussing each other’s finances. Financial intimacy is about aligning financial goals, being transparent about debts and assets, and navigating money-related challenges together. Its foundation is communication and trust. It may not always be all that easy, but it’s worth the effort.

Let’s get back to sharing salary information in private life.

- The percentage dropped slightly in the case of non-romantic relationships. 78% of the survey takers revealed how much they earned to their best friends, who seemed almost equally open about their finances. 81% of respondents claimed they had knowledge about their best friends’ salaries.

And how about sharing salary information at work?

- Almost 8 in 10 (78%) participants claimed that they had discussed salary with their colleagues.

- 82% said their company had a policy of keeping employee salaries confidential. Interestingly, the percentage is higher in the case of answers given by manufacturing industry workers (97%).

- Only 3% admitted that none of their colleagues knew how much they earned, and 2% claimed that they didn’t know the salary of any of their colleagues.

A full breakdown of more detailed data is below.

Do any of your colleagues know how much you earn [excluding your manager or supervisors]?

- One or two people at work know how much I earn – 30%

- A handful know how much I earn – 36%

- Tons of colleagues know how much I earn – 31%

- None of my colleagues know how much I earn – 3%

Do you know what your colleagues earn [excluding anyone you manage or supervise]?

- I know the salary of one or two of my colleagues – 32%

- I know the salary of a handful of my colleagues – 37%

- I know the salary of tons of my colleagues – 28%

- I don’t know the salary of any of my colleagues – 2%

But just why is financial transparency at work so important?

“Including a salary range isn’t just about attracting candidates or staying compliant with local legislation. It’s about creating better pay transparency overall, which will help your company strengthen its employer brand and empower progress toward pay equity.”

—Rob de Luca, BambooHR

Gentlemen don’t talk about money, right? Wrong.

A Few Words Before You Go

It’s often said that money isn’t the most important thing, and that’s 100% true. But financial health is crucial to our well-being as employees and as individuals. Breaking down the financial transparency taboo isn’t about celebrating the importance of money, rather it’s all about putting the power in worker’s hands.

“Our relationship with money is one of the most important in our lives. For better or worse, it can impact our happiness, our self-worth, and what we value and prioritize. (…) Better financial well-being is significantly and positively related to better physical health, mood, satisfaction with work, household activities, social relationships, family relationships, leisure time activities, ability to function in daily life, economic status, living/housing situations, overall well-being, and far, far more.”

—Thriving Wallet Survey by Thrive Global and Discover

Finances play too important a role in our life to keep silent about them.

Methodology

The above-presented findings were obtained by surveying 1109 respondents online via a bespoke polling tool. They were asked questions about money-related issues. These included yes/no questions, scale-based questions relating to levels of agreement with a statement, questions that permitted the selection of multiple options from a list of potential answers and a question that allowed open responses. All respondents included in the study passed an attention-check question.

Limitations

The data presented relies on self-reports from a randomized group of respondents. Each person who took our survey read and responded to each question without any research administration or interference. There are many potential issues with self-reported data like selective memory, exaggeration, attribution or telescoping. Some questions and responses have been rephrased or condensed for clarity and ease of understanding for readers.

Fair Use Statement

Want to share the findings of our research? Go ahead. Feel free to use our images and information wherever you wish. Just link back to this page, please — it will let other readers get deeper into the topic. Additionally, remember to use this content exclusively for noncommercial purposes.

About Resume Now

Resume Now is a powerful resource dedicated to helping job-seekers achieve their potential. Resume-Now’s AI resume builder is a cutting-edge tool that makes creating a resume fast, easy, and painless. Resume Now has been dedicated to serving job seekers since 2005. Alongside its powerful AI resume builder and stylish, ready-to-use templates, it also features free advice for job seekers at every career stage, guides for every step of the hiring process, and free resources for writing cover letters. Resume-Now is committed to supporting job seekers and workers alike and has conducted numerous surveys related to the experience, trends, and culture of the workplace. These surveys have been featured in Business Insider, CNBC, Fast Company, Yahoo!, Forbes, and more. Keep up with Resume-Now on LinkedIn, Facebook, X, and Pinterest.

Sources

- Bennet, R., “Most Americans Are Significantly Stressed about Money — Here’s How It Varies by Demographic”

- De Luca, R., “Pay Transparency Tips: How to Include a Salary Range and Write Better Job Posts”

- Fox, M., “Negotiating a Job Offer Works: 85% Of Americans Who Counteroffered Were Successful. Here’s How to Do It”

- Heydari, A., “Sharing Salary Information Can Narrow Wage Gaps — But Studies Show More Equality Can Mean Less Pay”

- Keeter, S., “Many Americans Continue to Experience Mental Health Difficulties as Pandemic Enters Second Year”

- Ryu, S. & Fan, L., “The Relationship Between Financial Worries and Psychological Distress Among U.S. Adults”

- Stahle, C., “Pay Transparency in Job Postings Has More than Doubled Since 2020”

- Thrive Global and Discover, “Thriving Wallet Survey”

- Tretina, K., “Inflation vs. Recession”

- White, A., “90% Of Americans Say Money Impacts Their Stress Level, According to Survey”

Was this information about The Power Of Financial Transparency helpful? Let us know!

Heather is the Content Strategy Manager for Resume Now and a Certified Professional Resume Writer (CPRW) with more than ten years of experience writing about job search and career topics. She is based in San Francisco.

More resources

How to Make a Canadian Resume (Format, Template + Examples)

Creating a Canadian resume is key to getting a job in Canada. ...

How to Write a Resume for an Internal Position (Guide + Examples)

Ready for a new role within the same company? We ll help you...

The Great Workplace Reckoning: How 2025 Burned Out Workers & What’s Next for 2026

Resume Now provides a look inside the burnout pay and ethics...

Software Developer Resume: Examples & Templates

Build & download your Software Developer resume in a few simpl...

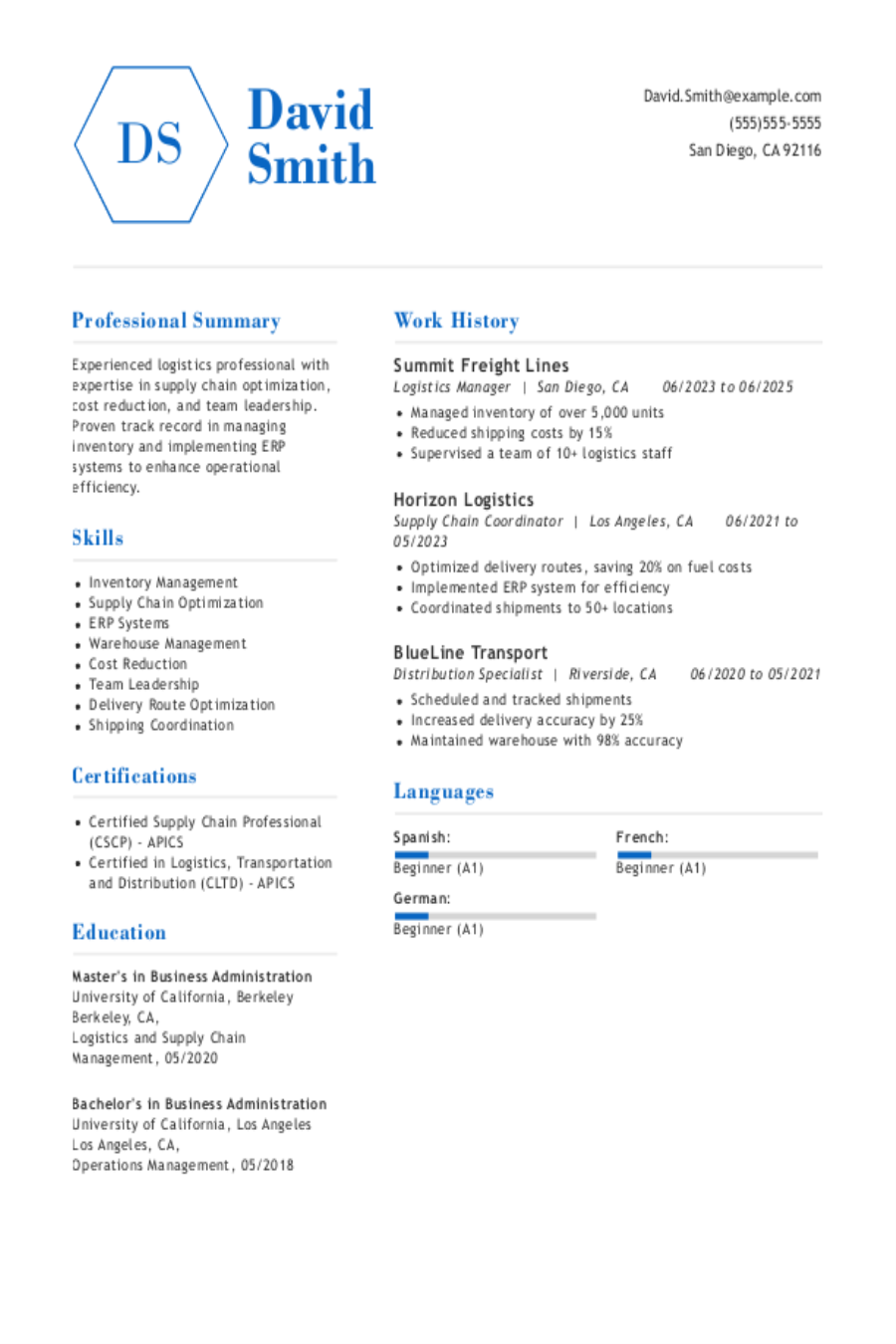

Logistics Resume: Examples & Templates

Build & download your Logistics resume in a few simple steps. ...

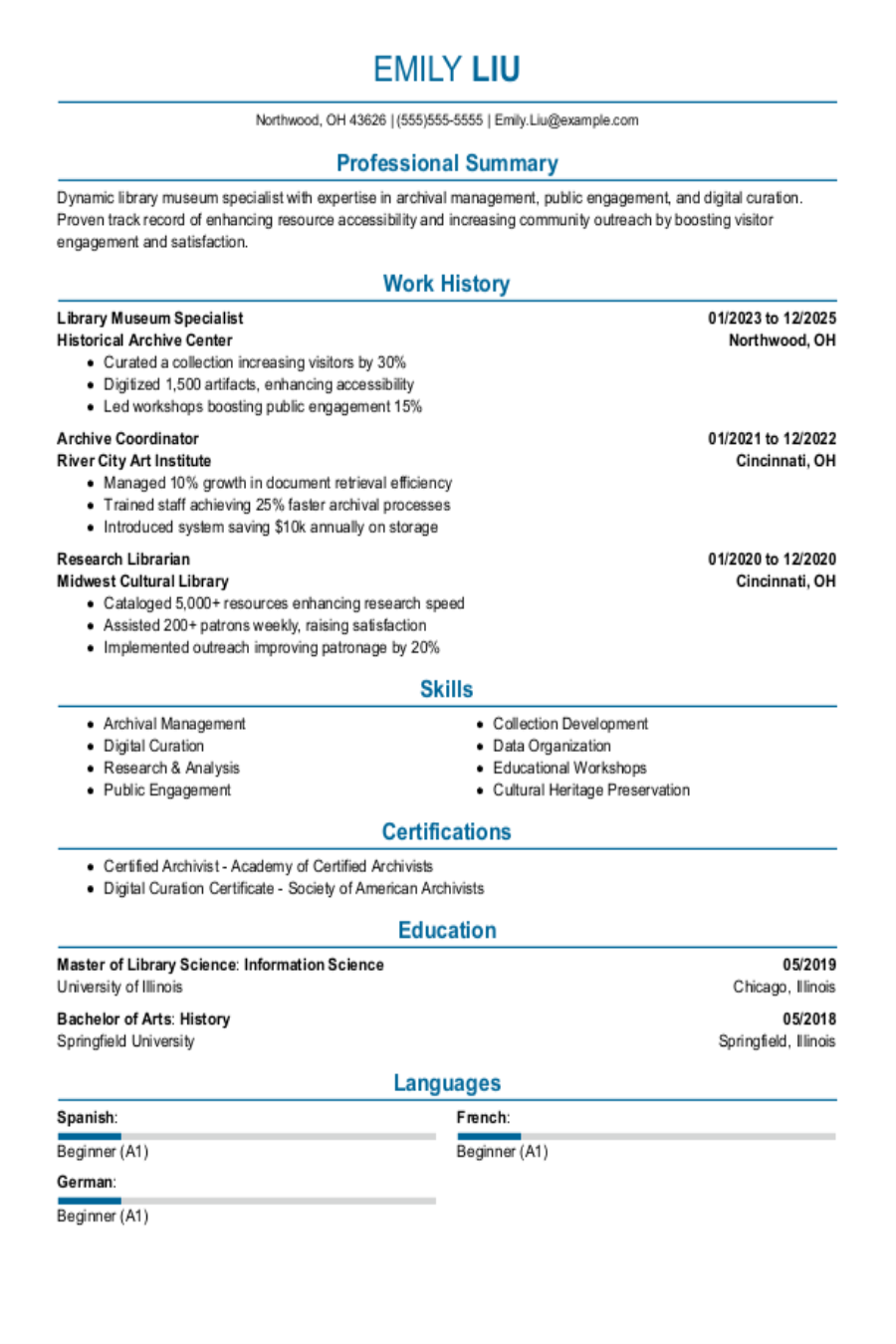

Library Museum Resume: Examples & Templates

Build & download your Library Museum resume in a few simple st...