Popular Accounting Resume Examples

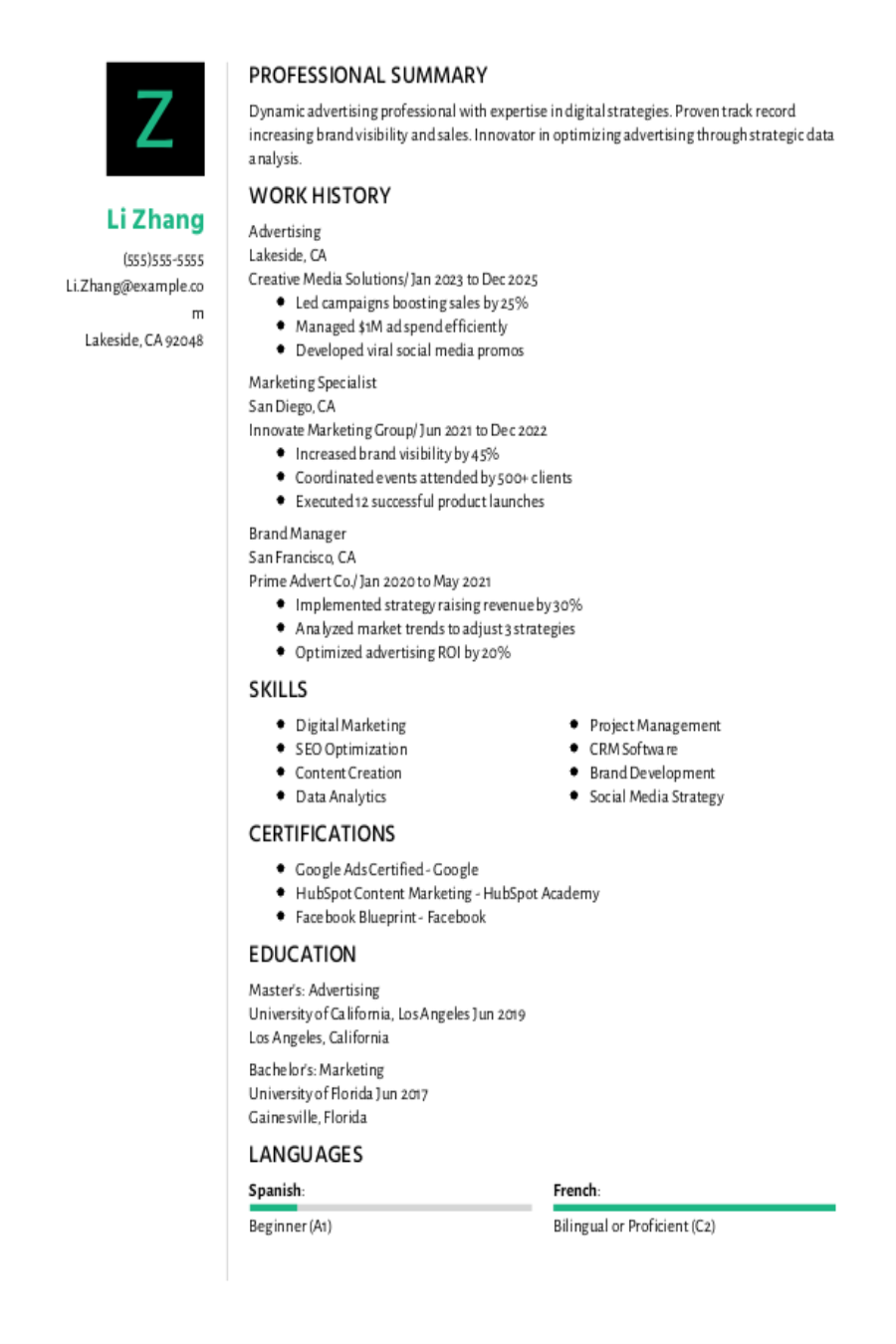

Entry-level accounting resume

An entry-level resume for accounting should highlight relevant coursework, internships, technical skills such as skill in accounting software, and strong analytical abilities to showcase potential despite limited experience.

Focuses on goals: The job seeker demonstrates a strong foundation in accounting through effective roles, focusing on process optimization and cost reduction while pursuing continuous professional development and certifications to improve skills.

Prioritizes clarity: Choosing a simple resume template allows recruiters to easily identify your qualifications, boosting the likelihood of creating a strong first impression in the competitive accounting field.

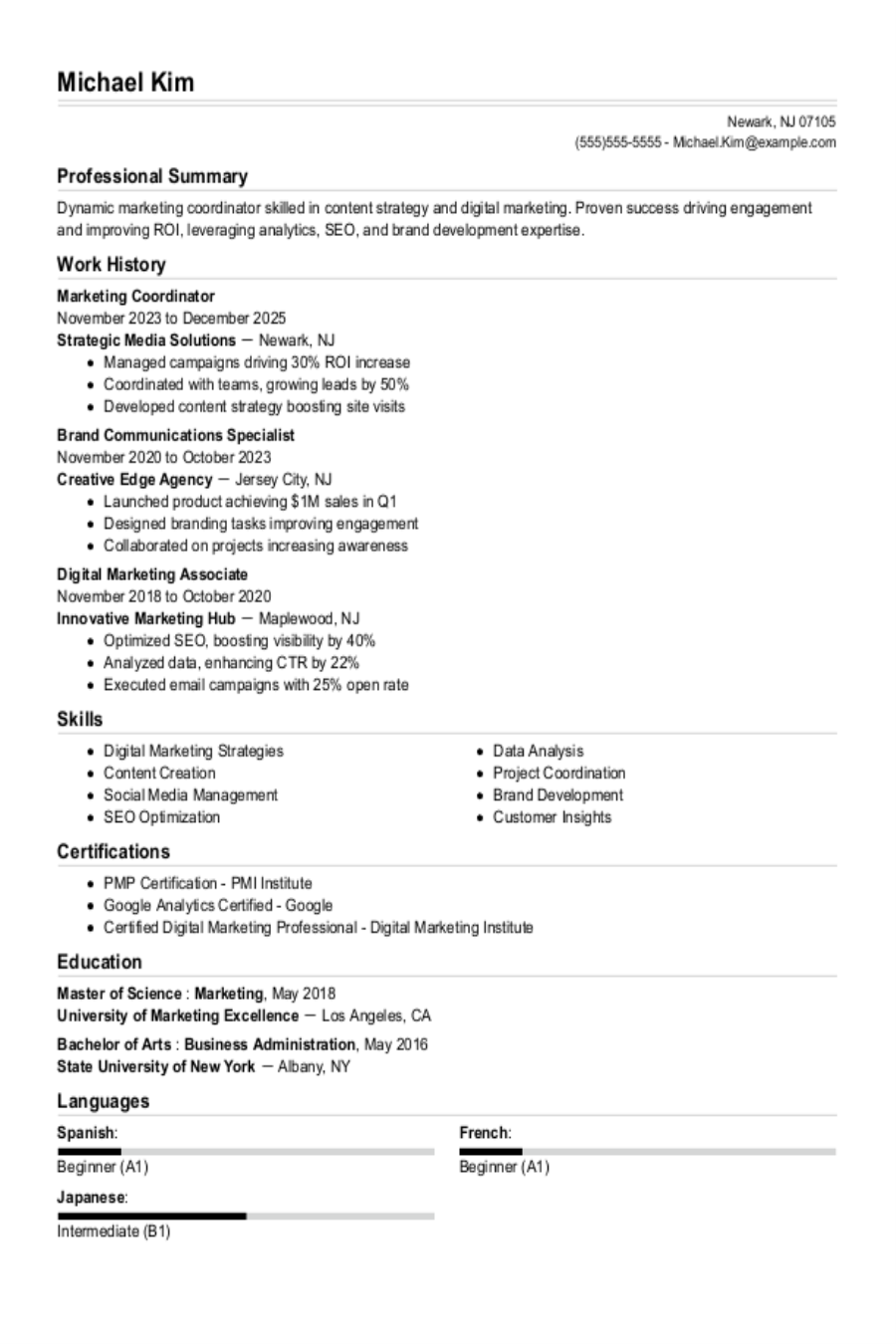

Mid-career accounting resume

A mid-career accounting professional's resume should effectively showcase a mix of relevant experience, technical skills, and evidence of continuous growth to attract potential employers in the competitive finance industry.

Uses active language: Strong action verbs such as "managed," "led," and "developed" highlight leadership and measurable results, showcasing initiative in driving financial efficiency and accuracy.

Balances hard and soft skills: This resume effectively highlights a mix of hard skills, such as financial reporting and GAAP compliance, with soft skills like team leadership and mentorship, demonstrating the job seeker's well-rounded expertise in accounting.

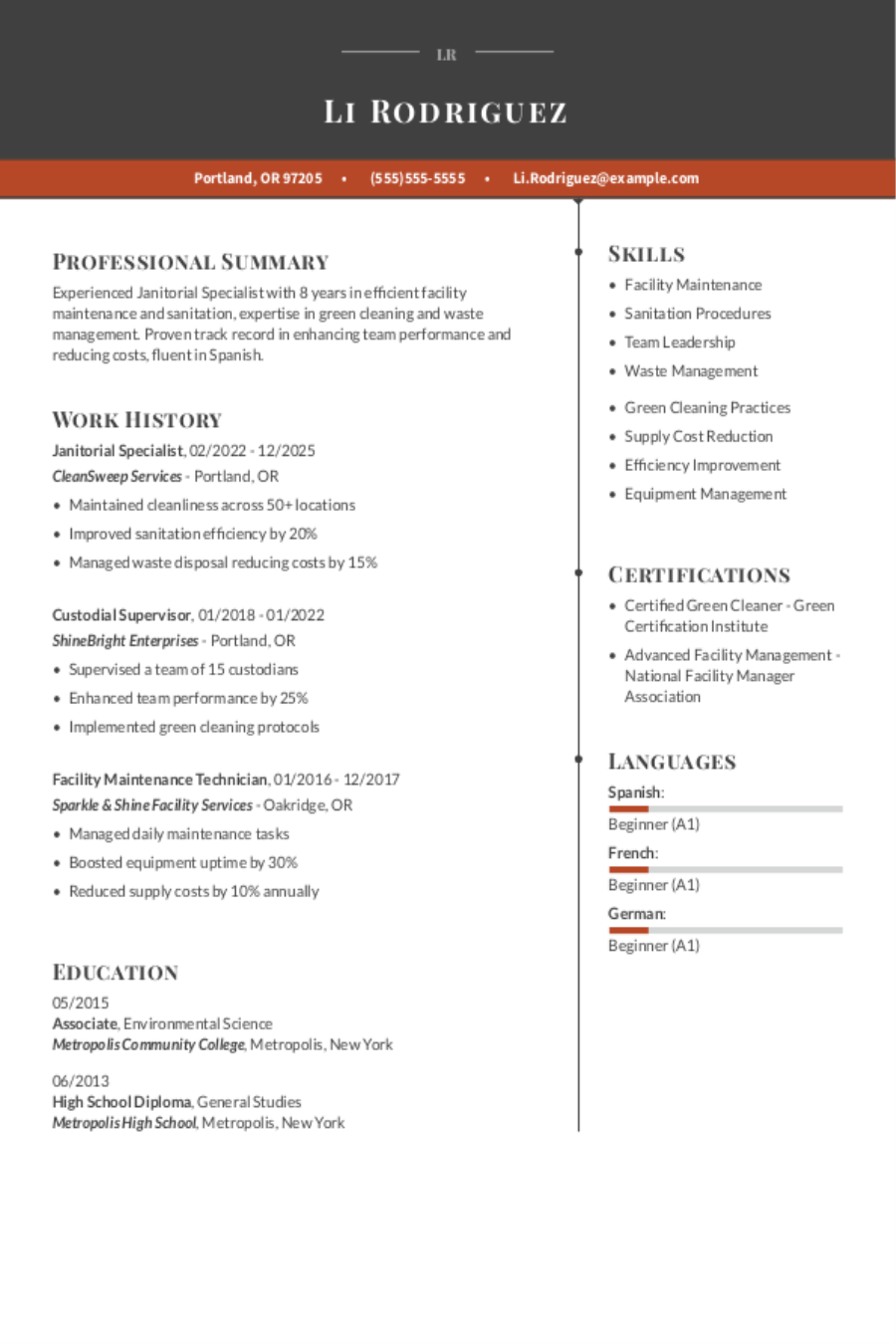

Experienced accounting resume

An experienced accounting resume should emphasize quantifiable achievements and relevant skills, clearly illustrating the applicant's career growth and contributions within the field to attract potential employers.

Leads with experience: The resume's opening summary effectively showcases 11 years of extensive experience in accounting, highlighting key achievements such as a 20% increase in efficiency and significant cost savings. This immediately establishes a professional tone, signaling the applicant's capability to add value from day one.

Embraces a modern resume style: This modern resume template effectively showcases the job seeker's innovative accounting expertise, emphasizing their achievements and professional growth while presenting a polished and contemporary image to potential employers.

No experience accounting resume

A resume for an applicant with no experience should highlight relevant skills, educational achievements, and any volunteer or extracurricular activities that showcase the applicant's potential and readiness for an accounting position.

Avoids jargon: Job seekers often feel compelled to embellish their experiences with complex terminology, thinking it will improve their appeal. However, a straightforward approach highlighting genuine skills and responsibilities can resonate better with potential employers, showcasing clarity and integrity in their qualifications.

Uses a simple style: The resume's clean design effectively highlights key achievements and relevant experiences in accounting, allowing qualifications to shine through without unnecessary distractions.

More resume examples

Additional Guides

Accounting Resume Template

Kickstart your job application with this versatile accounting resume template. Easily personalize it by adding your details and showcasing your unique qualifications and experiences.

Sophia Singh

Miami, FL 33101

(555)555-5555

Sophia.Singh@example.com

Professional Summary

Dedicated accountant with 9 years of experience. Skilled in financial analysis, budget management, and audit preparation. Proven success in cost management and financial reporting.

Work History

Accounting

Financial Nexus Group - Miami, FL

May 2021 - August 2025

- ManagedM annual budget, enhancing cost efficiency by 15%

- Led monthly financial audits, reducing errors by 20%

- Developed financial models that increased ROI by 25%

Senior Accountant

Summit Financial Solutions - Riverview, FL

September 2016 - April 2021

- Reduced tax liabilities by 10% through effective strategies

- Supervised a team of 5 accountants, boosting productivity by 30%

- Streamlined billing processes, saving K annually

Junior Financial Analyst

Visionary Finance Inc. - Miami, FL

September 2013 - August 2016

- Analyzed financial data, contributing to a 10% sales increase

- Prepared quarterly reports, enhancing transparency by 15%

- Assisted in budget planning, facilitating 0K cost savings

Skills

- Financial Analysis

- Budget Management

- Spreadsheet Proficiency

- Audit Preparation

- Data-driven Decision Making

- Financial Reporting

- Regulatory Compliance

- Cost Management

Education

Master's Degree Accounting

University of Southern California Los Angeles, California

June 2013

Bachelor's Degree Finance

University of California, Los Angeles Los Angeles, California

June 2011

Certifications

- Certified Public Accountant (CPA) - California Board of Accountancy

- Chartered Financial Analyst (CFA) - CFA Institute

Languages

- Spanish - Beginner (A1)

- French - Beginner (A1)

- German - Intermediate (B1)

Writing Your Accounting Resume

Having explored various resume examples tailored for accounting positions, you’re now prepared to dive into the detailed process of crafting your own. We’ll walk you through how to write a resume step by step, ensuring each section highlights your skills effectively.

List your most relevant skills

An effective skills section on your accounting resume is important for showcasing your qualifications to potential employers. It should highlight both your technical abilities, like skill in financial software and knowledge of tax regulations, as well as essential soft skills such as analytical thinking and attention to detail. By carefully reviewing job listings, you can identify the keywords from the job listing that resonate with what hiring managers are seeking, ensuring that your skills align perfectly with the role.

Incorporating these keywords improves your visibility in applicant tracking systems (ATS). These systems often scan resumes for specific terms related to the job description. By using language that reflects the requirements listed by employers, you increase your chances of passing through initial screenings and landing an interview.

Example of skills on an accounting resume

- Proficient in managing financial statements and budgets with precision

- Adept at using accounting software like QuickBooks and Excel for efficiency

- Strong analytical thinker with a knack for problem-solving

- Excellent communicator who collaborates well within teams and with clients

Highlighting your soft skills on your resume is important. While technical expertise is essential, employers greatly value interpersonal abilities, as they are often challenging to develop. Showcasing these traits can set you apart and demonstrate your potential to thrive in a collaborative work environment.

Highlight your work history

Your work experience section is important for your accounting resume, as it highlights not just your job roles but also your achievements. This is your chance to demonstrate how you've effectively applied key accounting principles and skills in practical situations. Be sure to include specific accomplishments that illustrate your impact, using strong action verbs and relevant keywords that will attract hiring managers' attention.

When detailing each job entry, it's essential to include your title, the name of the employer, and the dates you were employed. This foundational information helps establish your professional credibility and allows employers to quickly assess your background.

Example of an accounting work experience entry

- Accounting

XYZ Financial Services - New York, NY

January 2019 - Present - Prepare and analyze financial statements and reports for management, improving decision-making with accurate data insights.

- Streamline accounts payable and receivable processes, reducing processing time by 30% while ensuring compliance with regulatory standards.

- Conduct thorough audits of financial records to identify discrepancies, leading to a 15% reduction in errors over the previous fiscal year.

- Collaborate with cross-functional teams to develop budgets and forecasts, aligning departmental goals with organizational objectives.

- Mentor junior accountants on best practices in accounting software usage and regulatory compliance, improving team efficiency by 25%.

Quantifying achievements in accounting is essential for illustrating your impact on financial performance. For example, saying you reduced processing errors by 40% within a year not only demonstrates your attention to detail but also highlights your contribution to the overall efficiency of the organization.

Include your education

The education section of your accounting resume should be structured in reverse-chronological order, starting with your most recent academic achievements. List all relevant degrees and diplomas, while omitting your high school diploma if you hold a bachelor's degree or higher. Including honors or distinctions can improve this section and make your qualifications stand out.

For those currently pursuing a degree or engaged in ongoing education, it’s essential to highlight your highest completed level and include an expected graduation date. Adding bullet points that showcase relevant coursework, projects, or significant academic accomplishments can provide additional value for candidates with less on-the-job experience.

Common certifications for an accounting resume

- Certified Public Accountant (CPA) – American Institute of Certified Public Accountants (AICPA)

- Chartered Financial Analyst (CFA) – CFA Institute

- Certified Management Accountant (CMA) – Institute of Management Accountants (IMA)

- Enrolled Agent (EA) – Internal Revenue Service (IRS)

Sum up your resume with an introduction

Your resume's profile section is your chance to make a lasting first impression. It introduces who you are as a professional and sets the tone for the rest of your application.

For experienced job seekers, a professional summary is ideal. This format allows you to showcase your most significant accomplishments and relevant skills upfront, making it easier for potential employers to see why you're a great fit for their organization. For less experienced candidates, write a goal-oriented resume objective that gives employers a sense of your career development.

Professional summary example

Results-driven accounting professional with over 8 years of experience in financial analysis and reporting. Demonstrated ability to improve budgeting processes and optimize financial performance, contributing to significant cost savings. Proficient in reconciliations, tax compliance, and using advanced accounting software to deliver accurate insights that support strategic decision-making.

Resume objective example

Detail-oriented accounting professional eager to apply strong analytical skills and attention to detail in a challenging role within a forward-thinking organization. Aiming to contribute effectively by using expertise in financial reporting and data analysis to improve the accuracy of financial operations and support strategic decision-making.

Pro Tip: Your resume profile is your chance to make a strong first impression. Incorporate relevant keywords from the job description into this section to improve your visibility in applicant tracking systems (ATS). By aligning your skills and experiences with the specific language used in the job listing, you improve your chances of being noticed by hiring managers.

Add unique sections to set you apart

Optional resume sections can significantly improve your accounting application by showcasing your unique qualifications. These segments allow you to present additional information that can set you apart from other applicants.

Incorporating sections such as relevant hobbies and volunteer experiences can provide insight into your character and work ethic. For instance, if you've volunteered for financial literacy programs or engaged in community fundraisers, it highlights not only your skills but also your values. Sharing these experiences reveals who you are as a professional.

Three sections perfect for a accounting resume

- Languages: In accounting, clear communication with clients and colleagues is essential. If you speak additional languages, highlight these language skills on your resume; it can improve client relationships and broaden your career opportunities in diverse markets.

- Volunteer Work: Incorporating volunteer work on a resume can improve your professional skills and showcase your dedication to making a difference. It not only fills gaps in experience but also highlights your commitment to community service.

- Quantifiable Metrics: In accounting, quantifiable accomplishments are important to validate your expertise and impact. Include them in your experience bullet points or create unique sections to house them.

5 Resume Formatting Tips

- Choose a format that matches your career stage.

Choosing the right resume format is important for showcasing your experience effectively. For those with a solid background in accounting, a chronological format helps highlight career progression. On the other hand, if you're starting out or switching fields, a functional resume can better emphasize skills over job history. You might also consider a combination format to balance both elements and increase your application's appeal to employers.

- Pick a smart resume template.

Using a professional resume template improves the readability of your document, making it easier for hiring managers to find key information quickly. A well-structured template not only streamlines formatting but also ensures that your resume is ATS-friendly. Opt for clean layouts and clear fonts to present your qualifications effectively and stand out in a crowded job market.

- Select an appropriate font.

When selecting fonts for your resume, opt for clear options like Helvetica, Garamond, or Verdana. Choosing a professional font improves readability for both applicant tracking systems (ATS) and hiring managers, ensuring your qualifications shine through effectively.

- Use consistent formatting.

Ensure your resume features clean, left-aligned text with uniform margins to improve readability and create a polished, professional look that grabs attention.

- Keep your resume to one or two pages.

When crafting your resume, remember that resumes should be one page long to ensure clarity and focus. If you have extensive experience, a two-page format is acceptable, but prioritize concise content that highlights your most relevant achievements and skills.

What’s the Average Accounting Salary?

Accounting salaries vary based on location, career level, and qualifications.

This data, provided by the Bureau of Labor Statistics, will show you expected salary ranges for accountings in the top 5 highest-paying states, including the District of Columbia. The figures reflect the most current salary data available, collected in 2024.

- Full Range

- Most Common (25th–75th percentile)

- Average

District of Columbia

Most common: $54,790 - $75,260

California

Most common: $47,300 - $67,350

Connecticut

Most common: $47,920 - $65,450

Massachusetts

Most common: $47,400 - $65,260

New York

Most common: $45,130 - $65,570

Tools for Your Job Search

Are you gearing up to apply for that exciting accounting position? Before you hit submit, take advantage of our ATS Resume Checker. This essential tool provides valuable insights into how your resume measures up against the automated screening systems commonly used by employers in the finance sector.

Need extra help polishing your application? Our AI Resume Builder is designed just for you, offering tailored recommendations based on your specific accounting experience and access to professional templates that effectively showcase your skills and qualifications to potential employers.

Frequently Asked Questions

Last Updated: September 18, 2025

Yes, a cover letter is important because it offers context to your resume and establishes a connection with potential employers. It allows you to convey your enthusiasm for the role and demonstrate how your skills and experiences make you an ideal job seeker. So, don’t hesitate—write a cover letter that highlights your unique qualifications!

For those looking for a quick solution, our AI Cover Letter Generator can help you craft a personalized cover letter in just minutes. You’ll find various cover letter template options that align perfectly with your resume, helping you present a polished and professional application effortlessly.

A resume is a brief document, typically spanning one to two pages, providing a snapshot of your skills and experiences. In contrast, a CV (curriculum vitae) can extend to several pages and includes detailed information about your academic history, research contributions, publications, and professional experience.

You should use a CV when applying for positions in academia, science, law, or specialized fields where comprehensive detail is required. If you need to create a CV quickly and efficiently, our online CV Maker service is the perfect solution. Choose from various CV templates designed for different industries and career levels to craft a tailored CV that stands out.

To craft an impressive accounting resume, select a modern and professional template. Be sure to integrate relevant keywords from the job description to effectively showcase your qualifications and align with the employer's needs.

A vibrant LinkedIn profile is important for accounting professionals seeking new opportunities. It allows you to connect with industry peers, showcase your expertise, and improve your visibility in the competitive job market.

To ace your accounting interview, practice job interview questions and answers. This preparation not only boosts your confidence but also equips you to handle any surprises that may come your way. Remember, being ready is key to making a great impression!

Was this information helpful? Let us know!

Leisha is a career industry editor dedicated to helping job seekers excel in their careers.

More resources

How to Write a Resume for an Internal Position (Guide + Examples)

Ready for a new role within the same company? We ll help you...

The Great Workplace Reckoning: How 2025 Burned Out Workers & What’s Next for 2026

The workforce spent much of 2025 in survival mode navigating ...

What Is a CV? Curriculum Vitae Definition & Who Should Have One

Do you need to know what a CV stands for? We share the definit...